Hey there,

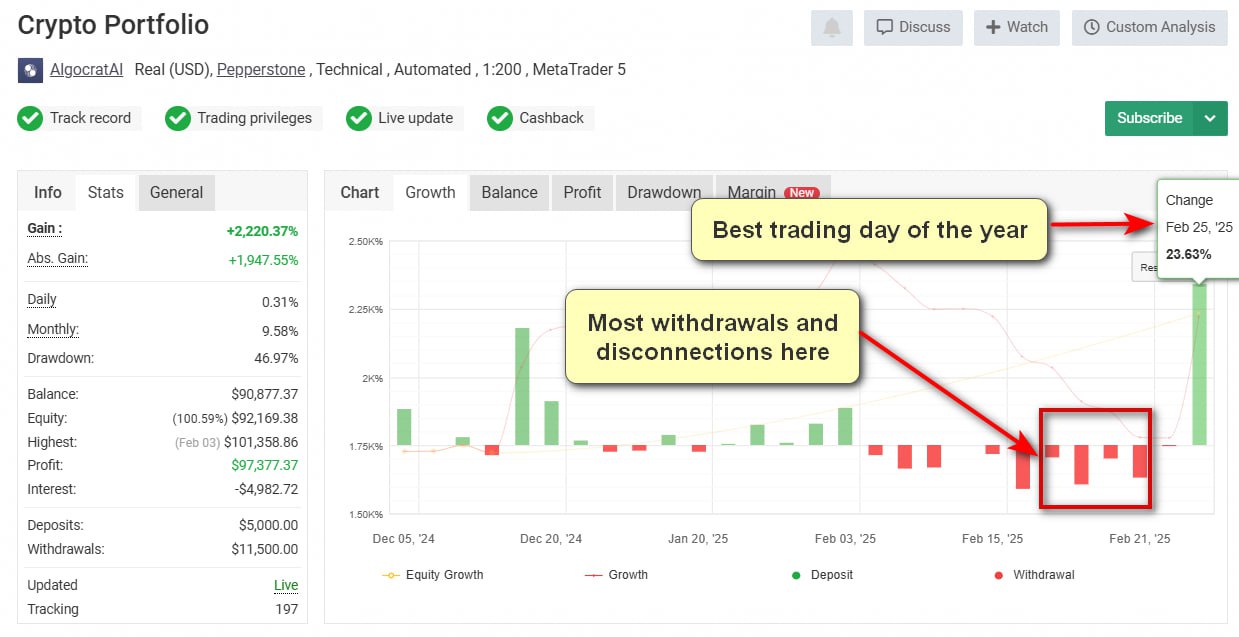

Recently, we witnessed classic investor behavior with Algocrat AI: a drawdown led to a wave of disconnection requests and withdrawals.

Then, almost like clockwork, the best trading day of the year followed:

On Pepperstone, we recovered most of the drawdown.

On Binance, we hit an all-time high.

This isn’t a one-time fluke — it happens repeatedly.

Investors have an uncanny ability to exit at the worst possible moment.

We even backtested a strategy that increased risk when people withdrew funds and decreased risk when they topped up their accounts.

The result?

Performance improved.

Of course, we won’t use this, but it’s a clear sign: most investors act irrationally.

Why markets are ruthless psychological machines:

Financial markets are like vast, perfectly tuned casinos designed to exploit every quirk of human psychology.

The more investors manually interfere, the worse their results.

This isn’t just anecdotal — there’s extensive research on the subject, dating back to the famous 1981 study “Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?”

Our own analysis confirms it: small market participants (retail investors) consistently lose money on average.

Why this happens?

Our brains were built for survival — not for trading.

This isn’t just a crypto phenomenon; it’s human nature.

Our instincts evolved for fighting predators and finding food, not managing risk in an algorithmic trading system.

When faced with a drawdown, our primal “fight or flight” response kicks in, leading to emotional, data-blind decisions.

Ironically, this is what makes trading profitable — for those who resist these impulses.

When you stay on the opposite side of trades made by panic-driven investors, aligning yourself with institutional players, you position yourself to win.

This is precisely how Algocrat AI systems work.

So, how do you beat the cycle of fear?

You can’t change your emotions, but you can change how you act upon them.

The best approach to algorithmic trading is simple:

1. Find a professional system with long-term proven profitability. (If you’re reading this, you’re already luckier than 99% of people)

2. Assess your risk, and either accept it or stay out.

3. Commit to the strategy.

Simple as that.

Second-guessing professional traders almost always results in missed profits or losses.

If the trader isn’t a professional, why would you trust them with your money in the first place?

Trading isn’t for everyone — and that’s okay

Algorithmic trading requires discipline.

If you can’t help but intervene at every hiccup, or if you panic at the first sign of trouble, trading might simply not be for you.

That’s not a failure — it’s a realization.

Many people aren’t suited for this, and that’s perfectly fine.

But if you can trust the process,

If you can stay the course,

The rewards will likely be there.

Best regards,

The Algocrat AI Team