The feedback about Algocrat AI we've received recently is that our current results are underwhelming.

And it's true: our performance this year is below average, especially compared to last year’s results.

However, it's quite common for Algocrat AI to experience lower-than-average results.

By definition, the average value means “roughly half the time we are below it”.

So, we decided to provide a more thorough look into the performance metrics of Algocrat AI throughout the years to see if what we’re experiencing right now is normal.

Here's how it works:

All the calculations and charts below were produced using the QuantStats library:

.jpg)

It's one of the most well-known quant libraries used to assess the performance of algorithmic trading strategies and various assets all across the globe.

It’s fully open-source, and the data we use is public, pulled from our third-party verified Myfxbook track records, which means anyone could reproduce the results we’re showing here.

Without further ado, let’s dive straight into the metrics.

First, let’s assess year-to-year performance:

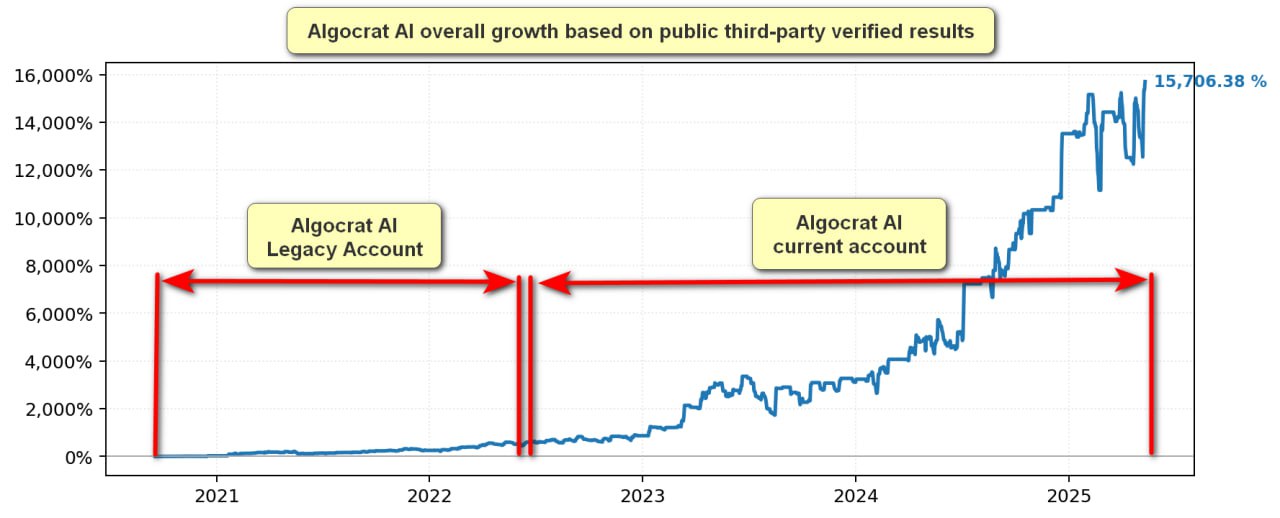

Algocrat AI has been trading publicly since 2020, as you can check in our Myfxbook account.

The overall return reached a phenomenal 15,000%, leaving Bitcoin in the dust:

Moreover, the worst full year we’ve had to date is 2022, where we made 173.74%

Pretty good for the worst year we’ve had so far.

Next, let’s take a look at a 6-month rolling Sortino chart, as one of the best available risk-adjusted performance metrics:

.jpg)

What we see is that the 2024 performance was well above average (at some point, Sortino reached an unrealistic 10.0), while the last 6 months are closer to average.

We’ve had such results many times before.

What’s interesting to note is that the 2024 performance was abnormal, almost twice the average year we observed before it.

So, it’s natural to see some regression to the mean afterward, since we do not usually make 300%+ per year.

This means that there is no statistically significant change from the past dynamics of the portfolio.

What we see now has been observed before on real, third-party verified public accounts.

So, what’s next?

After more than a decade of real-world experience in algorithmic trading, we’ve come to the inevitable conclusion:

Almost all attempts to predict the market’s medium-term dynamics (“Bitcoin is going to the moon, meet you at $200k!”, “Oh no, it’s falling all the way down to zero again…”) are pointless.

Nobody can do this with precision - it’s a losing game.

That’s why we don’t play it.

The best traders in the w

orld can predict short-term price dynamics with maybe up to 60% precision at some points.

That’s what we do:

Boring exploitation of statistically significant market effects we can observe and measure.

Since 2020 with unmatched results:

.jpg)

And that’s what we intend to continue doing.

If you'd like to come along:

Best,

The Algocrat AI Team