Google DeepMind recently announced AlphaEvolve, a Gemini-powered coding agent for general-purpose algorithm discovery and optimisation.

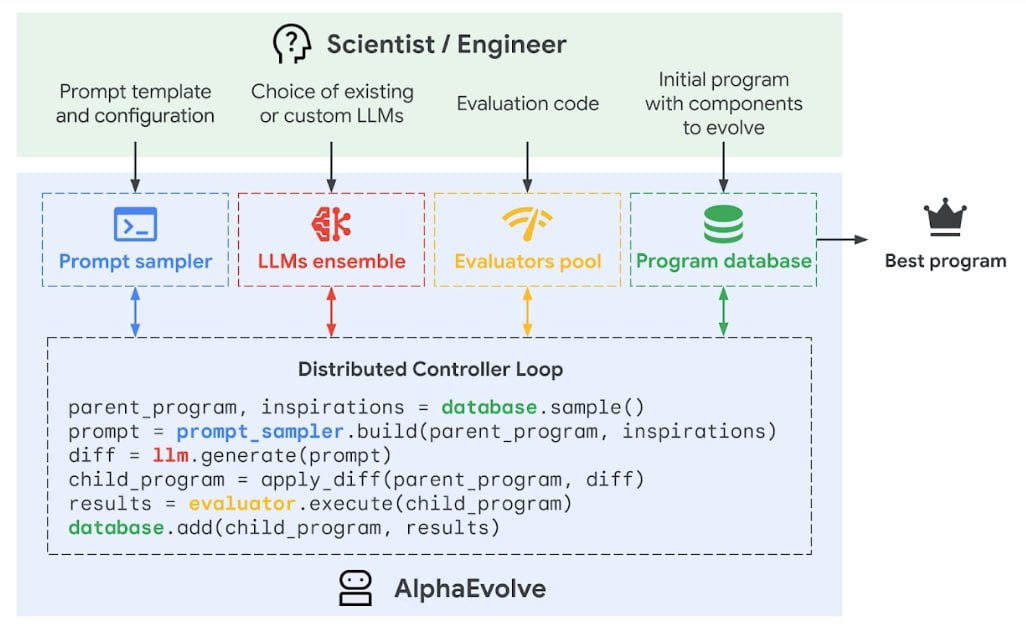

The system couples large language models with an evolutionary search loop and automated evaluators to iteratively improve code.

What AlphaEvolve actually is:

AlphaEvolve is not a single “AI tool” but a framework: you give it (i) a code skeleton or family of baseline algorithms and, (ii) a deterministic function that scores each candidate.

The agent then mutates, compiles and tests thousands of variants, keeping only the ones that raise the score:

In internal Google use it has, for example, discovered a heuristic that continually recovers ≈ 0.7% of the company’s global compute capacity and sped up a key Gemini kernel by 23%, trimming total training time by about 1%.

Why “just point it at trading” is harder than it sounds:

Trading success cannot be verified by a tidy, stationary metric the way matrix-multiplication speed can.

To adapt AlphaEvolve you would need—before the first experiment can run—all of the following,

🕹 A high-fidelity, deterministic market simulator:

It must model latency, slippage, margin and order-book micro-structure, because the evaluator has to produce exactly the same score each time it is called.

🔮 Forward-looking robustness tests:

An evaluator based only on historical P&L will be gamed by curve-fitting. You have to embed walk-forward splits, stress regimes and position-level risk limits.

🎯 Clear multi-objective criteria:

Real desks care about turnover, draw-down, capacity and compliance as much as raw Sharpe. Those must be baked into the score or AlphaEvolve will ignore them.

Without this groundwork AlphaEvolve will happily evolve strategies that exploit quirks of your back-test rather than patterns that survive live markets

Why human logic still matters:

At Algocrat AI we rely on logic and theoretical research to anchor every strategy.

AlphaEvolve can mutate that logic into something less transparent if the opaque variant scores better, so a human still has to:

📝 Design the evaluator to reward interpretability and parsimony

👀 Code-review the winners before capital is allocated

🔄 Retire or retrain strategies the moment live performance diverges

In short, the human must be smarter than the agent at defining “robust”.

AlphaEvolve supplies raw search horsepower, not market insight.

Is AlphaEvolve available yet?

As of May 2025, AlphaEvolve is in a closed Early-Access Programme for academic partners.

Google has invited researchers to register interest but has not announced a public cloud SKU or pricing.

Here's the bottom line:

AlphaEvolve is a promising addition to the quantitative toolbox.

Once it becomes publicly accessible you could slot it into an existing research pipeline, provided you invest the time to build a bullet-proof trading evaluator.

Until then, treat it as experimental infrastructure rather than a turnkey trading edge.

Why is this important to you?

At Algocrat AI, we're constantly studying the latest breakthroughs in AI — not just to understand them, but to apply them.

Our mission is to take real innovation and embed it directly into our systems — making them smarter, faster, and more reliable with every iteration.

The kind of edge you can access by joining us today:

Best,

The Algocrat AI Team

P.S. What's interesting is that there is a separate AlphaEvolve tool in fintech made for the specific purpose of finding novel trading systems. Not sure if Google knows about this, but it's mentioned that a patent was even filed for this system back in 2021.