As you've probably heard, ByBit was hacked for approximately $1.4 billion worth of ETH yesterday.

This ranks among the largest hacks in history, crypto or otherwise.

Yet, despite the scale of the incident, ETH has barely reacted, and today we are seeing a strong reversal, recovering yesterday's losses,

.jpg)

Additionally, all available reports suggest that ByBit is successfully managing the situation.

As an indicator of confidence, the **Polymarket ByBit insolvency market** is currently trading at a 4% probability, continuously decreasing.

Is the market going to fall further?

Nobody can predict the future, but if this event were going to trigger a major sell-off, it likely would have already happened.

The day of the event presented a real risk, which is why Algocrat AI systems were shorting the market.

While they ultimately exited with a small loss, they were positioned to capitalize on a potential downturn.

However, no system wins every trade - nor should that be the goal. Risk management and strategic positioning remain the priority.

How has it handled?

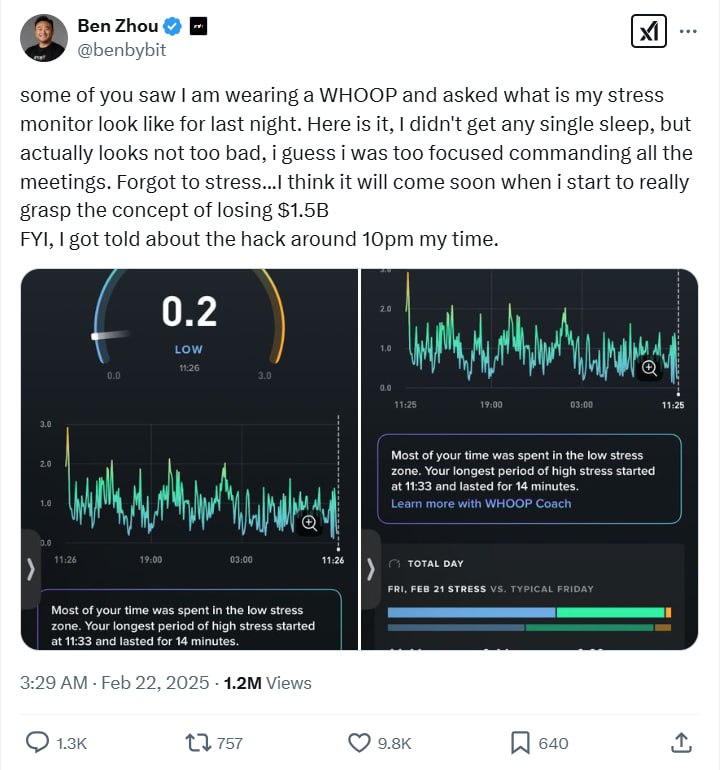

ByBit CEO Ben Zhou demonstrated a masterclass in transparency.

He stayed up all night, actively updating his X (formerly Twitter) account with details about the hack:

.jpg)

And even shared his fitness tracker stats from the day and night following the breach,

This is exactly how such situations should be handled - openly and responsibly.

What are we doing with our ByBit funds?

We haven't moved them. While there remains a small chance of ByBit insolvency, we consider it negligible.

For now, we remain confident in ByBit’s ability to manage the aftermath and continue operations smoothly.

Best,

The Algocrat AI Team