After the last post, a few clients asked us to elaborate further on the correlation aspect.

How can it be that there is zero correlation between Algocrat AI results and Bitcoin dynamics?

After all, Algocrat seems to trade trends, right? It should have some correlation - for instance, performing better during an uptrend dynamic, making the overall correlation at least slightly positive.

Well, not quite.. let's dive deeper into this topic.

The first misconception about Algocrat is that it’s a trend-following system.

What is trend-following in simple terms?

It's buying when the price is moving up significantly and selling when it goes down.

This means staying in the market most of the time, going either long or short depending on the prevailing trend. Such systems perform well during trending market periods and on trending instruments, such as Bitcoin.

Our team has developed similar systems and observed their results from other developers. Practice shows that while these systems can outperform Bitcoin over the long term, they fail to outperform Algocrat.

More importantly, they depend heavily on the overall market trend. If there is no significant trend in either direction, they tend to lose money. These periods of sideways movement can last for months.

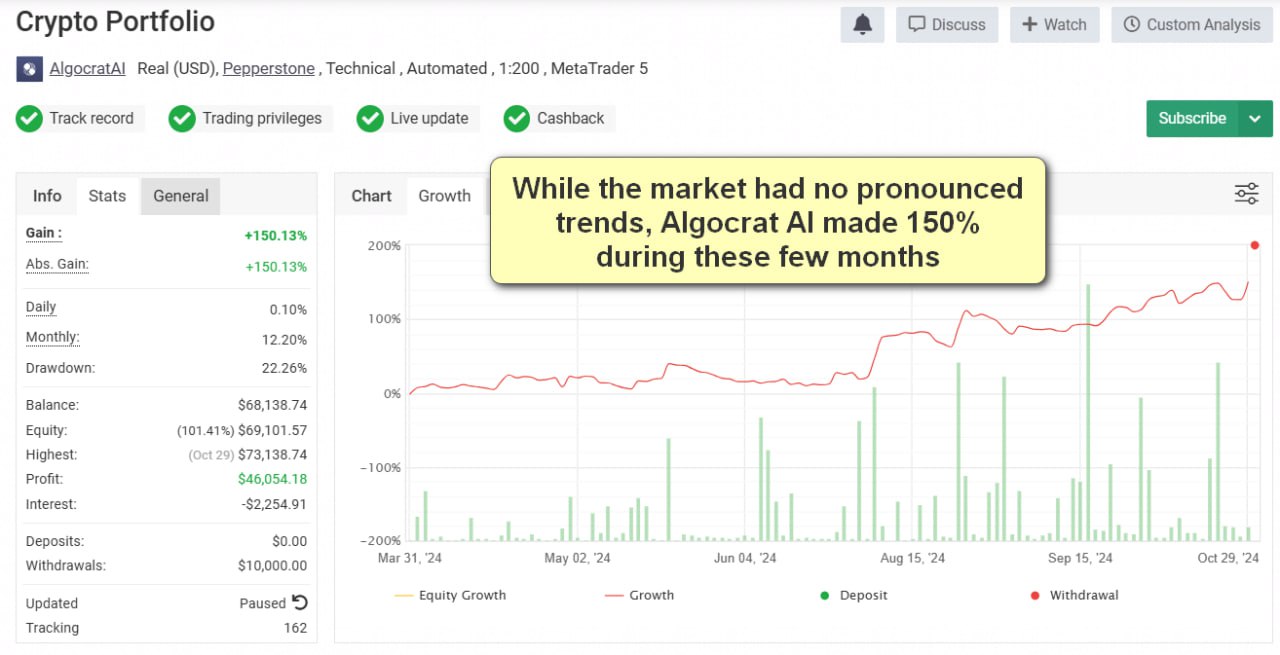

For instance, we recently had over six months of sideways movement, from mid-March until November’s Trump rally:

.jpg)

Algocrat AI achieved a +150% gain during these months, even though the market wasn’t trending. Such results would be impossible for any trend-following system in the absence of a trend:

What's Algocrat AI's strategy?

It’s a diversified portfolio of (mostly) intraday trading systems that capture short-term market dynamics.

We do not rely on sustained trending movements. Instead, we exploit short-lived momentum market inefficiencies when there is a high probability of capturing them.

This means we do not stay in the market all the time. This short-term approach is more sophisticated and tricky than typical trend-following systems.

To remain consistently profitable in the long run, we must be precise with our entries, whereas trend-following focuses more on staying in the market during trends.

The advantage of this short-term approach (apart from being more profitable for deposits under a billion dollars) is that we can generate returns even when the market is stagnant, thanks to these intraday movements.

What's the downside?

Limited scalability.

This approach can manage a few dozen million dollars but not hundreds of millions or billions.

Conversely, trend-following on a liquid pair like Bitcoin can handle significantly larger sums, even in the billions.

Since our focus is on maximizing profitability for relatively small amounts, up to a few dozen million dollars, it makes sense to stick with this short-term approach.

Scalability then is irrelevant to us because we are not managing billions of dollars.

On the other hand, trend-following has a major downside: its performance is tied to the “fate” of the instrument being traded.

While the instrument trends, trend-following systems perform well, but during non-trending periods, they lose money.

This creates a significant correlation and coefficient of determination (R^2) between the system and the underlying asset, such as Bitcoin. While correlation is well-known, R^2 is less familiar to the general audience.

Simply put, R^2 explains the percentage of a trading system’s returns that can be attributed to the underlying asset’s dynamics.

For example, an R^2 of 0.5 means that 50% of all returns are explained by Bitcoin’s market behavior.

Trend-following systems often have R^2 values of 0.5 or higher.

In contrast, short-term intraday systems are not dependent on overall market dynamics, so they typically exhibit R^2 values close to zero.

.jpg)

How do we observe that with Algocrat AI?

Its results are independent of Bitcoin’s overall dynamics. This is why we see an R^2 value of 0.00 and a correlation of 0.02 (essentially zero within the margin of error), as reflected in the charts.

.jpg)

This is beneficial for portfolio diversification, as zero correlation and zero R^2 indicate that Algocrat’s results are unaffected by overall market movements.

Consequently, Algocrat AI can deliver strong returns even when Bitcoin does not - and vice versa.

This post is longer and more technical than usual, but understanding the correlation between portfolio assets is crucial for investment success.

Without it, portfolio diversification can be undermined by highly correlated assets.

Algocrat AI's lack of correlation with Bitcoin makes it an excellent addition to a portfolio that includes Bitcoin, providing diversification benefits.

If you're ready to join us before the maximum AUM is reached, then take action and sign up right now:

🔗 Apply Now and Secure Your Spot

Best regards,

The Algocrat AI Team