As you have probably noticed, recent Algocrat AI results have been below our long-term average.

In this post, we explain the market backdrop and how we’ve responded.

First, the stats:

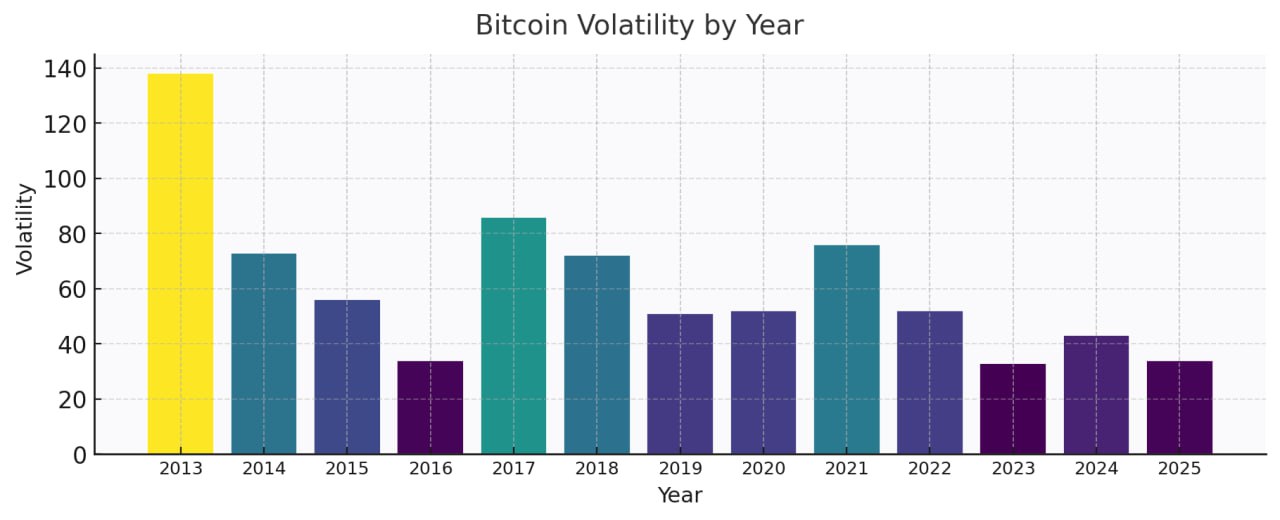

Our 6-month rolling risk-adjusted performance is roughly where it was in late 2023 and in our 2016 tester runs.

These are also the two least-volatile years in all of Bitcoin’s history:

This is not a coincidence, but rather a direct indication of the cause of the current underperformance.

What does it indicate?

Historically, crypto markets have exhibited momentum, which is why momentum-oriented approaches have made sense, while mean-reversion variants have generally underperformed.

Crypto has been maturing, and volatility has compressed.

So far this year, Bitcoin’s realized volatility has hovered near historical lows, similar to 2016 and 2023.

While this is only the third such low-vol period in ~15 years, we expect to see more of them as the market deepens.

Why is that relevant?

For momentum traders, the observable effect is a thinner opportunity set.

Lower volatility typically reduces gross returns, all else equal.

Since 2020, we’ve averaged ~200% gross per year publicly, and our best calendar year to date, 2024, ended above 300%.

It’s plausible we’re operating near the limit for this approach.

After all, we haven’t been able to find anyone who outperformed our trading on Bitcoin and Ethereum publicly since 2020.

And that has always remained our goal: to operate near the risk-return efficient frontier of crypto momentum.

But if the frontier becomes lower, so do our results, there is no way to avoid this.

How did 2024 deliver record results despite relatively muted volatility?

Two reasons,

1. Trend persistence and breadth don’t move one-for-one with volatility,

2. We shipped one of the largest system updates in Algocrat AI’s history in 2023, with ongoing refinements.

The stack continues to evolve toward the attainable frontier.

Because we expect more low-volatility regimes, we retuned the system this summer and rolled the changes into live accounts after a multi-month research cycle.

The trade-off is intentional: give up some upside in high-volatility spikes in exchange for better average outcomes in quieter markets.

Some of these changes are subtle, while others could have already been noticed by you.

Here's our plan moving forward:

In parallel, we continue to work on diversification.

Robust, public systems on major FX pairs are live and have performed well this year.

Given our deep background in FX, expanding to additional liquid markets is a natural next step for client value.

We’re also testing alternative models for BTC and ETH, several of which have been battle-tested in production.

However, as always, we prefer to triple-test everything before making it public.

Once we roll out some of these to the public, we'll announce it right away.

Best,

The Algocrat AI Team