We’ve recently completed a full year with Algocrat AI.

In this post, we’ll review the results from 2024 and analyze some of the key performance metrics of Algocrat AI. All of this analysis is based our verified MyFxBook.

Let’s dive in:

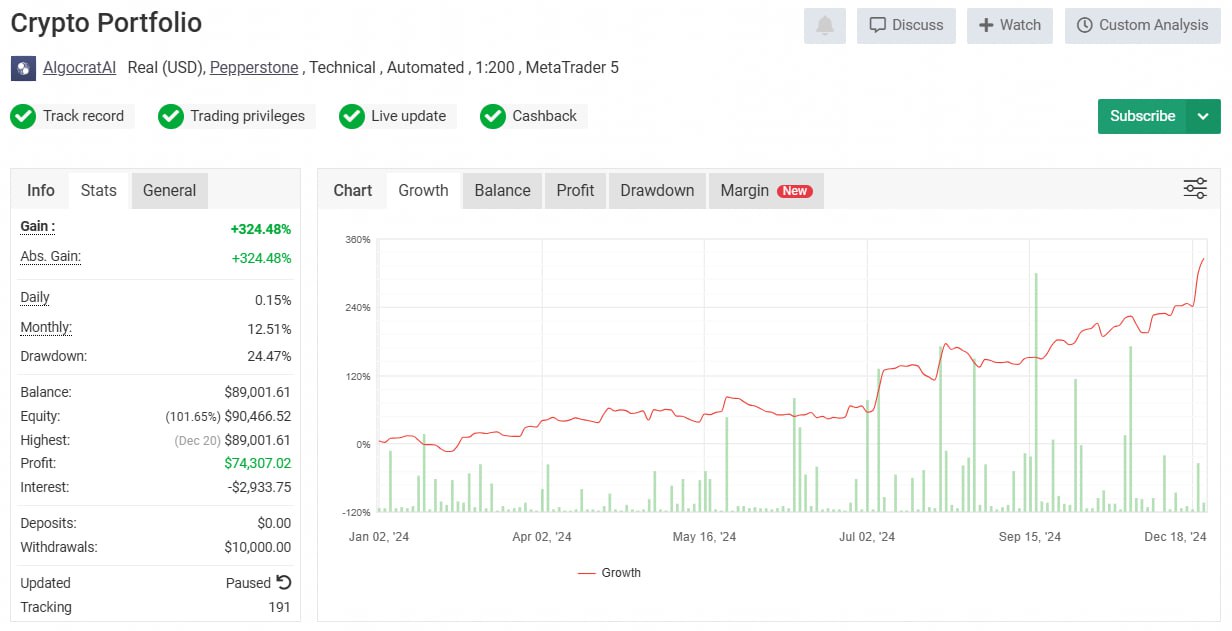

In 2024, Algocrat AI achieved a profit of 324.5% with a maximum drawdown of less than 25%,

This performance is higher than usual, as Algocrat AI typically delivers an average annual return of around 210% in the long run.

Therefore, 2024 was approximately 1.5 times better than an average year.

The exceptional performance suggests that 2024 was characterized by strong intraday trending movements, which Algocrat AI is designed to capture.

This isn’t surprising, given the significant bull run throughout most of the year.

Out of the 12 months, Algocrat AI delivered 10 positive months and 2 slightly negative months, with July being the best-performing month and December the second-best.

This near-perfect monthly performance indicates both strong strategy execution and a good alignment with market conditions,

.jpg)

The highest drawdown Algocrat AI experienced in 2024 was approximately 25%, lasting 13 days, from January 30th, 2024, to February 11th, 2024.

The second-largest drawdown was smaller, around 21%, and lasted approximately 1.5 months (42 days, to be exact)

What does all this mean?

That patience paid off well for Algocrat AI clients in 2024.

While there were significant drawdowns, some lasting over a month, almost all monthly periods closed with a profit.

Notably, there were no drawdowns lasting two months or more, which ensured that all quarters in 2024 were profitable.

How does Algocrat compare to its benchmark?

Since Algocrat AI primarily trades BTC, it makes sense to evaluate its performance against Bitcoin's. For this comparison, we’ll use Binance spot market data, given its status as the most liquid market.

From January 1st, 2024, to December 31st, 2024, Bitcoin delivered a return of approximately 125% with a maximum drawdown of 33.6% in August.

This means Algocrat AI outperformed Bitcoin both performance and risk-wise, even during a strong bull market phase.

Not only that, but Algocrat AI traded both Bitcoin and Ethereum, executing long and short positions,

.jpg)

Despite the market’s predominantly upward movement, Algocrat AI managed to generate profits from short positions on both BTC and ETH.

Hope you find this analysis valuable!

Best,

The Algocrat AI Team